Pure Storage Shows Off R&D Spend On New DirectFlash

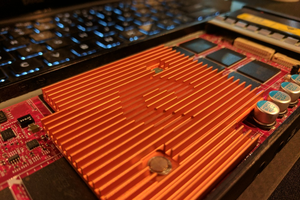

Pure Storage has unveiled its latest product, the DirectFlash powered FlashArray//X, which aims to bring NVMe connected commodity flash into the mainstream.

Until now, the flash inside Pure Storage arrays was SSDs from major suppliers. SSDs make flash look like older styles of disk by adding a software translation layer between the flash itself and the I/O bus of the computer systems they plug into. That's great for compatibility to a large pool of existing servers, but it's bit like putting reins and a saddle on a car so it can be compatible with a transport system based on the horse.

All that compatibility makes SSD technology more complex than it could be, and slows it down, as a trade-off for the speed to market. SanDisk used a similar translation bridge between the DDR3 memory channel and the flash in its ULLtraDIMM product a couple of years ago.

By updating to a newer connection standard of NVMe (think wheels instead of hooves) access to the flash can be much faster, and it opens up a bunch of other possibilities. NVMe products are now commercially available, and while it's still a high-end offering, by now it's clear that it will take over from other interface standards.

We can see from Pure's quarterly numbers that it continues to invest heavily in R&D as a percentage of revenues, even as it becomes more efficient and edges ever closer to profitability. In the last quarter, costs continued to come down across the board, with R&D the one stand-out that increased from 31.3% of revenue to 41.2%. Year-on-year, costs as a percentage of revenue continue to come down across the board.

The existing FlashArray//m series of devices shipped with dual SSD/NVMe connections inbuilt, so upgrading from SSD based modules to the new DirectFlash modules is simple. It shows Pure is thinking ahead as it develops its products, always with a mind towards keeping customers on the Pure Storage bus once they get on.

Pure's stock is down about 37% since IPO (at time of writing) and I admit I don't understand why the market disagrees with me on Pure's future prospects. I see a company that is maturely and steadily working towards profitability pretty much according to plan, while still continuing to bring out new products that are completely coherent with its overall positioning in the market. This isn't a company making mad excursions off into bizarre side-projects that destroy shareholder value while enriching the executives. Maybe that's what the market values these days?

I don't own any Pure stock (I have a diversified IRA administered by other people), though I keep thinking maybe I should buy some before the rest of the market discovers they're wrong. Or maybe I'm wrong and my money is safer where I can't play with it.

This article first appeared in Forbes.com here.