Pure Storage Announces FlashBlade//E to Wipe Out Spinning Disk

Pure Storage has announced a new line of capacity flash storage arrays called the FlashBlade//E.

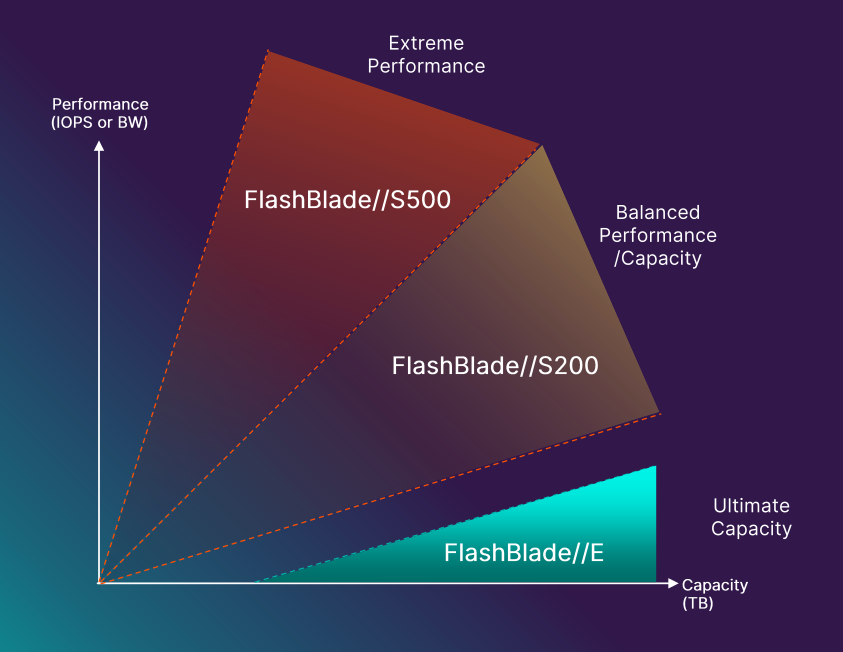

The FlashBlade//E is aimed at every day unstructured data use cases like data lakes, image repositories, backup targets, and big pools of raw data used by analytical systems. The focus here is on capacity, not performance, as we can see from this chart Pure uses to explain where FlashBlade//E fits in Pure's product portfolio.

The FlashBlade//E starts at 4 petabytes, and grows in 2 petabyte increments, so it's not going to replace your home NAS unless you have a serious data hoarding hobby. It's pitched below the FlashBlade//S200 in performance, and I'm told the gap between the FlashBlade//E and FlashBlade//S200 is deliberate. This is to make the decision clear for customers wondering if they should buy a FlashBlade//E or a FlashBlade//S200 for a given workload.

Like the FlashBlade//S, the FlashBlade//E speaks file and object—NFS, SMB, and S3 protocols—not block. The applications that the FlashBlade//E is aimed at all use these protocols, and the growth in apps using S3 is astounding so this choice makes sense.

The FlashBlade//E slots into the rest of the Pure portfolio nicely, and removes a reason to look at having another vendor to fulfil an unmet need. Provided the experience is good enough, it helps solidify Pure's current customer base while also providing a another way to acquire new customers. Existing customers expanding their footprint provides a solid baseline for revenue growth, and I expect quite a few customers will be interested in adding a FlashBlade//E to their existing lineup.

I also expect new customer acquisition to pick up, mostly from customers switching away from whoever makes their current HDD-based array. This shouldn't be a controversial point, but let's do some joined-up thinking about why this is likely.

The Hidden Agenda

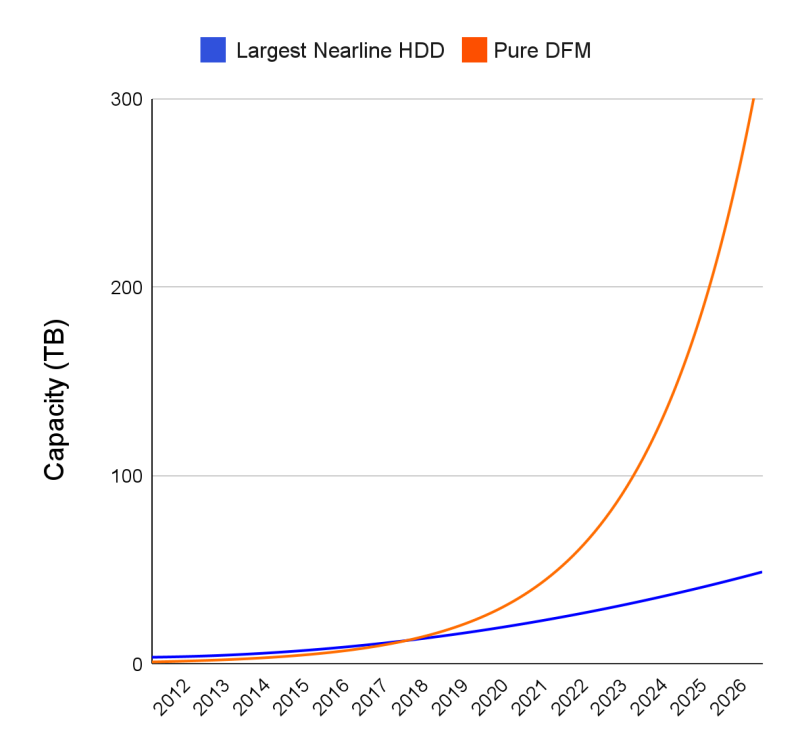

Quietly lurking in the slides accompanying the announcement was a fascinating chart with profound implications. Take a look and see if you can spot what I mean:

There are a few parts to this, so I'll step through them.

Here in 2023 we have already reached the point where the exponentially increasing capacity of Pure's Direct Flash Modules (DFMs) have overtaken the biggest spinning hard disks. This aligns out with recent PivotNine research on QLC flash densities and their performance. According to this chart, Pure Storage expects its DFMs to exceed 100 TB capacity before 2024 and reach 300TB around 2026.

Consider the maximum size of a spinning disk hard drive today. You can get around 20TB at the start of 2023, with manufacturers looking to bring out new HAMR-based drives sometime this year that can store 30TB and maybe reach 50TB by 2026 or so. Pure is signalling that it expects to be able to provide DFMs with six times that density in the same timeframe.

Now combine both of these facts with Pure's announced pricing estimate: USD$0.20c per GB (before data reduction) for FlashBlade//E which includes 3 years of service. 20TB hard disks are available for about $0.05 cents-per-GB at retail, if you can find stock, so expect to at least double that to add the array they'll live in, plus installation and support, and you're getting very close to if not exceeding $0.20c per GB today. Recall also that Pure is a premium brand that aren't really trying to be the cheapest possible option.

This all means that the days of buying hard drives are coming to an end.

Market shift

This is a market phenomenon that isn't limited to Pure. I'm sure we'll see plenty of noise from Pure competitors in the coming days questioning the pricing assumptions and pointing out they're cheaper if you plug in slightly different assumptions into a spreadsheet.

Ignore all that.

What matters here is the overall industry trend: hard drives are going to go away.

It won't happen overnight because data migration is a PITA and there are a lot of hard disks out there. But hard disks die, and with a standard warranty period of 5 years, that means someone who bought an array full of spinning rust yesterday will start looking at new options around 2026 just as Pure's ~300TB DFMs arrive. How confident are you that they'll buy a new array full of spinning disk when they can get the same capacity for the same price, but made of flash?

I know what I'd choose, and I suspect more and more people will join me as time goes by.

The flash vendors aren't going to be stealing market share from each other so much as they'll be swamped with business from people replacing HDD-based systems with flash. We simply aren't storing less data, so the capacity part of the market is going to grow faster than the high-end performance market.

People buying new storage will make the break to flash faster than those with a large existing fleet of HDD-based arrays, just as they did for performance flash. The incumbent vendors are going to be under a lot of pressure to come out with some kind of capacity tier flash that fits the same part of the market that the FlashBlade//E does.

There will be some competition for flash deals where customers explore a few options, but we're in market expansion phase now, not fighting for 0.5% of market share on razor-thin margins. Vendors would do well not to spend too much time on marginal deals duking it out for months when they could be signing up five new customers switching off a creaky old HDD or hybrid array in the same time. These deals will be simpler and easier to close.

Similarly, for customers it's mostly going to be about understanding what you're actually trying to do with your data and how it fits into your overall plan for data management. If you'd like some help with that, PivotNine would be only too happy to help.