The Perceptual Fingerprint™

The Perceptual Fingerprint

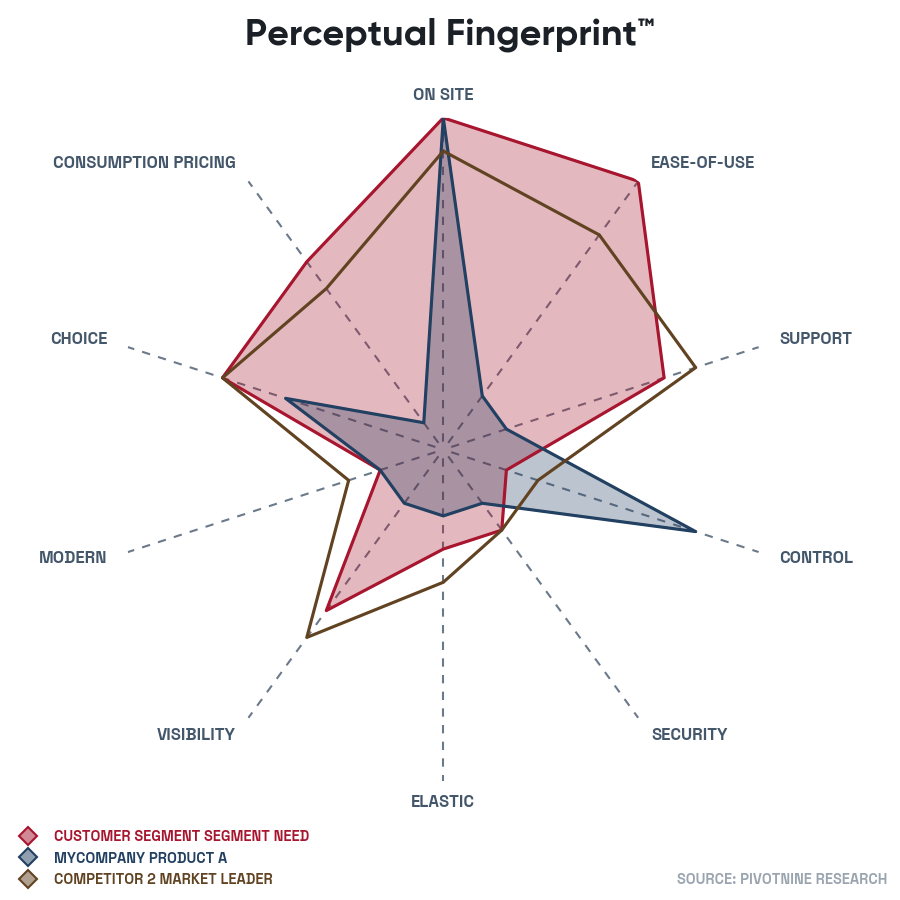

The PivotNine Perceptual Fingerprint™ provides a quick, visual way to assess how well a vendor offer meets a customer need, and the relative position of that offer compared to competing offers.

We use Perceptual Fingerprints to analyse both products and services, and to provide insight into competitive positioning. We use it as a tool to guide our analysis of markets, vendor offers, and customer needs. We also use it to help our clients tune their product and marketing strategies.

With a Perceptual Fingerprint, we can tell—at a glance—how well positioned an offer is, and so can you.

The Fingerprinting Process

We have found that working through the Perceptual Fingerprint process provides great clarity to clients all by itself. Some clients have found this to be the most rewarding part of the Perceptual Fingerprint exercise.

One client, a developer tools company, found that their initial meetings with prospective customers were particularly frustrating. It would take 20-30 minutes of discussion for a prospect to understand the offer, what it did for them, and where it fit into their mental model of the developer tools market.

After working through our Perceptual Fingerprint process, this client found that prospective customers quickly understood the offer in less than a minute. Rather than getting bogged down in attempts to explain why a customer should care, our client found their conversations quickly moved on to discussions of the customer's needs and challenges and where our clients products might help. These conversations were not only far more successful in converting early leads into qualified sales opportunities, they were also far more enjoyable, both for our client and their customers.

Clients have also found they are able to more clearly articulate their product and marketing strategy internally after working with us. Clients report greater alignment, lower friction, and less frustration in what is often already a high-pressure environment. Clients simply spend less time spinning in circles and more time working on problems they can clearly see and articulate to each other.

After many client engagements, we've refined our process to the following steps:

- Identify market boundaries

- Identify customer need dimensions

- Assess needs and offers

- Iteration and refinement

Identify Market Boundaries

The first stage in our process is to agree on the market boundaries. This is often harder than it seems. "What business are you in?" is a deceptively simple question. We find that getting the client leadership team to explain themselves to others—in clear, straightforward terms—often highlights gaps in understanding and alignment.

Agreeing on what the market is enables us to determine who the customers in that market are, and from there to determine what they want. Without this basic understanding of who you are trying to reach, it is difficult to design a product or service that people will want to buy from you.

Identify Customer Need Dimensions

We then work with clients to determine a set of around 7-12 dimensions (sometimes called selection criteria or factors) that are important to customers when evaluating vendor offers. While this obviously over-simplifies the process customers follow to select a vendor, we have found that this is a practical number of dimensions that balances accuracy and usefulness. Many more dimensions makes the analysis process overly complex, and there tends to be substantial overlap between the dimensions. Fewer dimensions tends to limit the usefulness of the analysis.

Working through this process focuses clients to make difficult decisions about what is truly important and what can be safely ignored. The discipline of this process is what leads to greater clarity. The editing process of removing what is not necessary leads clients to a better understanding of their own product and the market more generally.

We have found the most important breakthroughs tend to happen in this part of our process.

Assess Needs and Offers

Defining The Offer

Clearly defining offers is also an illuminating exercise. Just as with defining the market discussed earlier, defining what it is you sell seems easy… until an external consultant makes you write it down. Then we start to discover the grey areas of confusion or disagreement, and working through this confusion is an important part of the process.

By clearly defining what is important in the previous step, we are able to guide clients to seeing their own products with fresh eyes. Sometimes we share a moment of wide-eyed wonder as we collectively realise that the product should actually be quite different to what it currently is. Clients suddenly realize what hasn't been working and why, and can see a clear path to fixing the issues.

It is immensely gratifying to help our clients find these moments of clarity. Having the weight of confused misunderstanding suddenly lifted from your tired and weary shoulders is a wonderful feeling.

Assessing Offers

Once we clearly understand what we're assessing, we then help our clients to assess their own offer along the dimensions we previously defined. When warranted, we commission custom research to provide wider validation of our assessment with expert panels, representative customer panels, or other sampling methods.

An important part of this assessment process is to define a customer ideal that all offers are assessed against. The customer need is at the core of the Perceptual Fingerprint™.

For most engagements, we work with clients to assess their perception of the customer need using whatever existing data they have on their target customers. Customer needs are assessed on the dimensions discussed above. We can also commission custom research to obtain primary data from customers themselves for added assurance.

We also assess the client offer and competing offers on the same dimensions, using the same methods. The resulting dataset is processed to provide the Perceptual Fingerprint™ which clearly shows the alignment—or lack of it—between the various offers and the customer need.

Competitive Analysis

Analysing competing offers and how closely they match the customer need, and how different they are from the vendor offer, provides insight into competitive positioning. Competing on dimensions with a poor fit to customer need would be a mistake. Competing on the same dimensions that a competitor also focuses on may be challenging as the offer is less likely to be distinctive.

Focusing on dimensions that provide a good fit with customer desire, and that are also a better match than competitors, is the easiest and likely most effective way to obtain a distinctive offer. However, this relative positioning is not static, so care must be taken to assess the wider competitive landscape and watch for trends. If a competitor is actively working to close the gap on a particular dimension, this may be a poor dimension to invest in communicating differentiation. However, it may also represent an important competitive dimension where an investment in defending a distinctive position requires competing on this dimension.

Iteration and Refinement

Our process is defined to be iterative. As clients work through the process, we update the set of dimensions based on what is most effective. If a new, important dimension is identified when assessing competitor offerings, or uncovered during primary research with customers, it simply makes sense to include it and update the analysis. The Perceptual Fingerprint is quick to update, and easy to interpret, and helps clients to build an intuitive feeling for which changes matter and which ones don't.

Tracking the Perceptual Fingerprint through time also provides a useful strategic tool. Watching the shape of the customer need change, and the competitive response from others in the market, provides a useful way to understand market dynamics. We are able to observe how customers emphasize different dimensions through time. Similarly, we can observe how competitors respond to client tactics and the changing customer need.

A single fingerprint provides a snapshot of the market at a particular time. Assembling a collection of fingerprints over time provides a movie of how the market changes, and watching this time-lapse movie helps clients to predict where the market is likely to move next. The Perceptual Fingerprint is easy to integrate into an overall process of gathering marketing intelligence to inform decision-making.

Clients also report that learning this process helps them to become self-sufficient. They are able to perform their own analysis independently of PivotNine, which is our goal as consultants. We want all of our clients to be able to solve their own problems using the tools we've provided to guide their thinking.

More Information

For more information about the Perceptual Fingerprint, contact your PivotNine account representative or email [email protected].